World of credit cards

Things to know before getting a credit card

This post is a basic finance guide for beginners to understand about credit cards

Are you are thinking of buying your first credit card? If yes then you should definitely read this post, as it will help you weigh the pros and cons of buying one based on your circumstances. Like everything, no one size fits all, especially in finances, so it is very important to judge your situation rather than blindly following any advice.

Let's start with some basics first.

A credit card simply loans you some money for interest (charge for the money you owe them). So whenever you purchase anything from a credit card, you are essentially taking a loan from the bank in return for some interest.

Just like a bank gives you a loan based on your take-home income and other things (which we will discuss in detail in another post), your credit card loan also depends on your loan appetite.

The only catch here with credit card loans is that, you won't be charged any interest if you pay your full loan amount in the upcoming credit card bill. This means you get to use the extra money for some time and then return it back.

Now that the basics are out of our way, let's assume you have a credit card with a limit of 50,000 INR (imagine your currency equivalent). You use this card to buy a television worth 20,000 INR in January 2022. It was a steal deal and they even offered you 2000 INR discount for paying through a specific card. So the total cost was just 18000 INR. Isn't that great, your credit card just saved you 2000 rupees.

Now let's understand how the payment works.

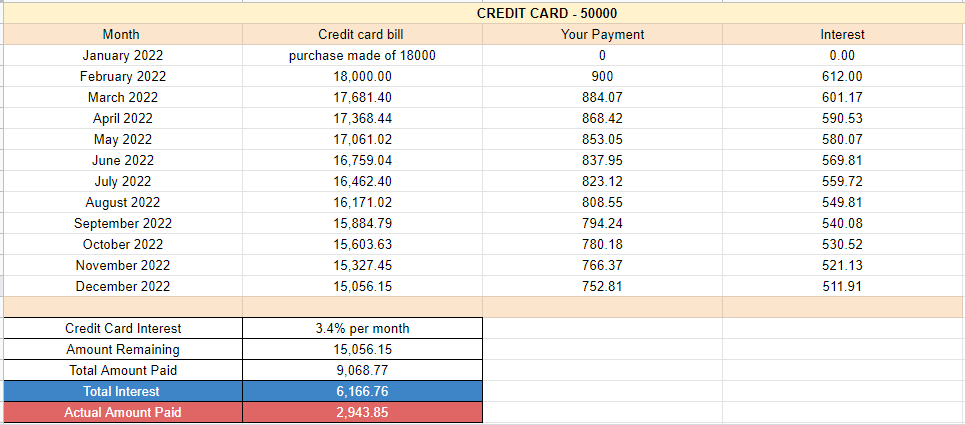

As we can see in the image above, you do not pay any interest for the month of January. Then in February as you pay the minimum payment amount which is 5% in our case, you are charged interest for the remaining amount. The interest for most banks ranges from 2.5% - 3.5% monthly. I have considered the interest rates of one of the leading bank's credit cards in India, which is 3.4%. So the interest charged is 612 INR, which leaves you with 17,861 INR even though you paid 900.

If you follow through with this minimum payment path for 12 months, you will be charged an interest of 6,166 rupees, which is way more than the discount you received. And during these 12 months, you would have paid 9,068 rupees in repaying the loan but would still have 15,000 in the end to pay back. So in order to save some money upfront, you fell into the trap of paying almost 6000 rupees.

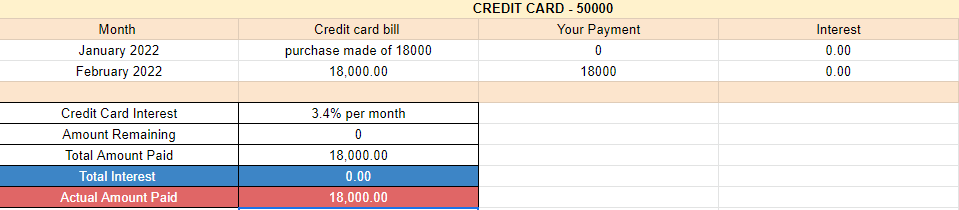

On the other hand, if you had maybe 9000 INR to spare from your current salary, and then decide to buy a television worth 18000. You could keep this 9000 aside for the whole month and add the remaining 9000 from your next month's salary to pay 18000 in full. Following this way of purchasing a television worth 18000 from your credit card, you would have received a discount of 2000 and at the same time, you didn't have to pay hefty interest. Check out the image below to understand this better.

Takeaway from this post would be that, using credit cards can definitely save you money by getting good cashbacks or points for future purchases only if you follow the second way.

If paying credit cards in full every single month is something youcan afford, then credit cards can no doubt offer you great benefits but if it’s not something you trust yourself with or can't afford right now, you could fall into the trap of paying the minimum amount and then end up in huge debt before you even know.

Choose wisely based on your money habits and circumstances. Happy Saving!