Got your first salary?

Learn how to manage money from the very beginning

This post is beneficial for someone starting out to manage their finances.

If you are anticipating a pay cheque soon or if you have already received your first salary and have no clue how to go about managing it then, continue reading to take steps towards your financially stable future.

Let's follow along with an example of Mr. Hank.

Mr. Hank received his first salary of 25000 rupees and his major expenses are rent, groceries, and other miscellaneous bills. Hank pays rent of 8000 every month and groceries and other expenses like electricity bills cost him another 8000.

So let's begin creating a budget for him.

1. Create a new savings account.

This is one of the most important steps when you start saving. I have seen a lot of people that still do not have this in place and use their salary account for both savings and expenses. This step is essential for setting boundaries. If you are in a mall (or scrolling online) to shop and find something you really like, that costs for instance 10,000 rupees and when you check the balance in your account and find more than 10,000, this might give you an unrealistic idea of having more money than your want (things that are not necessary at the moment). This will most likely make you spend that 10,000 as you would believe to still have enough money left after this purchase. But what you don't realize is that, the actual amount left after deducting your savings was just 2000. So technically at this point, your "want" shouldn’t be more than 2000.

Thus, seeing money more than you need can make you spend more than you can afford. So the best strategy to avoid this is, to keep your savings and expenses in separate accounts.

2. Calculate your monthly expenses.

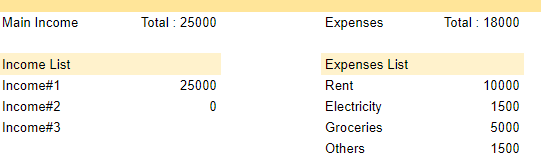

Hank here in our example has expenses that cost him 16000 every month. So that's his montly expense. This number can be different for everyone. So I would suggest using the old school method and writing down all your expenses on monthly/weekly basis. Check out the image below to understand how to breakdown your expenses.

3. Set up an Emergency fund.

Emergency fund is money that you use during emergencies or unplanned circumstances.

Now if you are someone that does not have a lot of responsibilities yet or any dependents to take care of, this might not be a crucial step for you. But for the purpose of having a stable future financially, having this fund handy at any point in time is extremely important. So if you have rent to take care of or even if you don't, I would suggest to still maintain an emergency fund.

Start with just 5% of your salary, or you can go higher up to 10% or 20% if you have much more things to take care of.

So since Hank has a rent to pay, he definitely needs an emergency fund for any unplanned situations like getting laid off from his job or any sudden house maintenance to look after. He could use this fund to take care of his rent or any other expense that might come up in difficult times like getting laid off, to function smoothly until he finds a new job, which could be in 3 to 6 months, or even more. For this he should have at least 16000 * 3 = 48000 or 16000 * 6 = 96000 in his fund. As 16000 is his current monthly expense , he needs a fund of atleast 3 to 6 months.

For setting up this fund, he could start by keeping some money aside every month. So maybe 2000 or 3000 rupees depending on the situation.

4. Create a final saving budget.

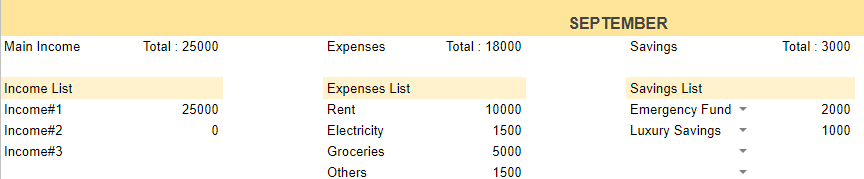

So after all the hard work, it's time to finally reap the benefits. So Hank’s budget with his monthly salary of 25000 would be (drum roll). Check out the image below to undestand how to piece together all the above points.

Look carefully (zoom in on the image if you are reading this from your phone) and try to create a similar one for yourself. There’s a category - Luxury savings, that can be used for any future trips or anything you would want to splurge on.

That's all on saving your first salary. Hope you are motivated enough to save and learn more about managing finances.

I am working on a finance tracker excel sheet and if you are interested in getting a pre-made excel tracker for yourself then definitely sign up below to receive it at no cost whenever it's out.